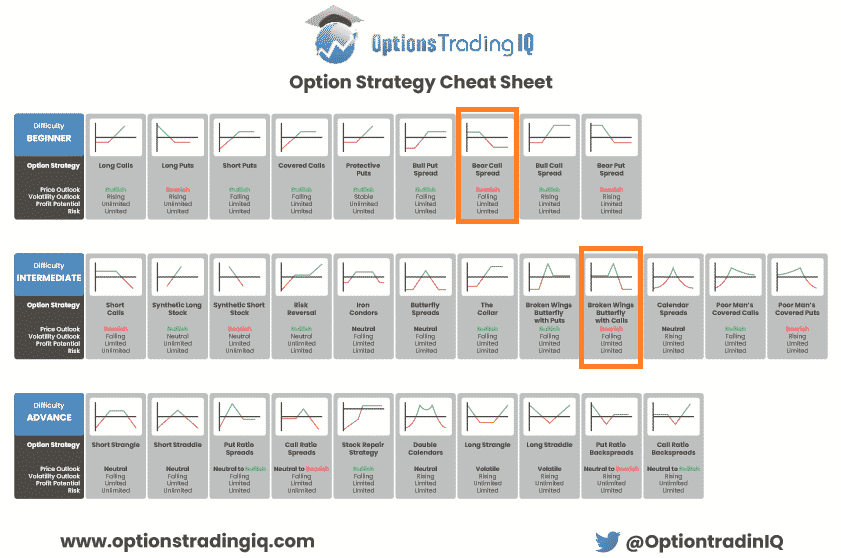

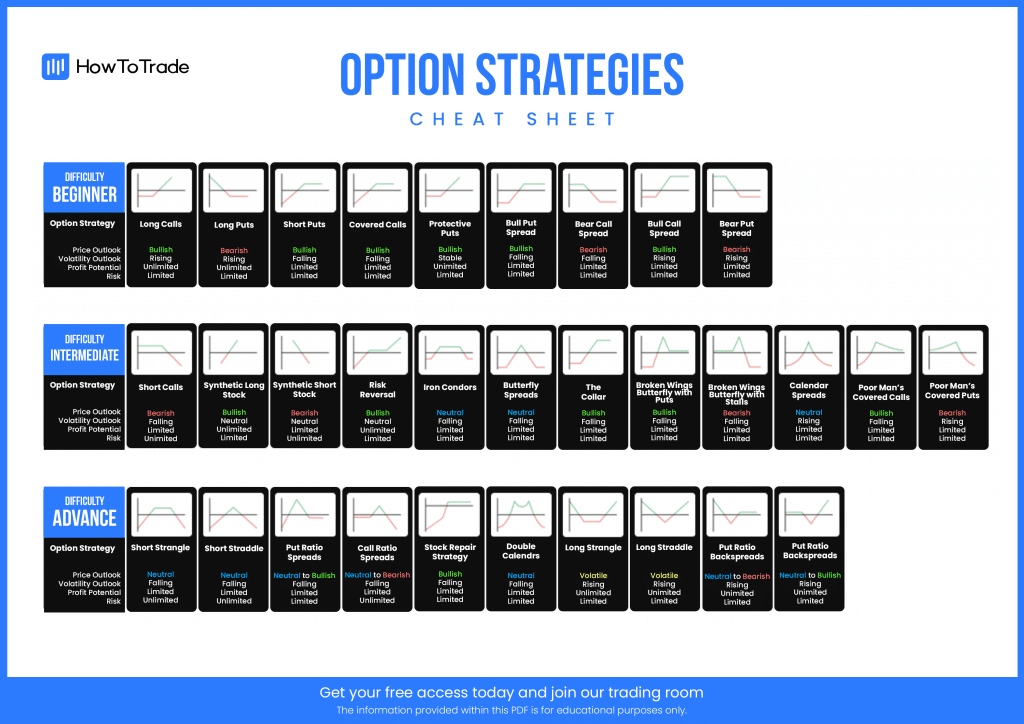

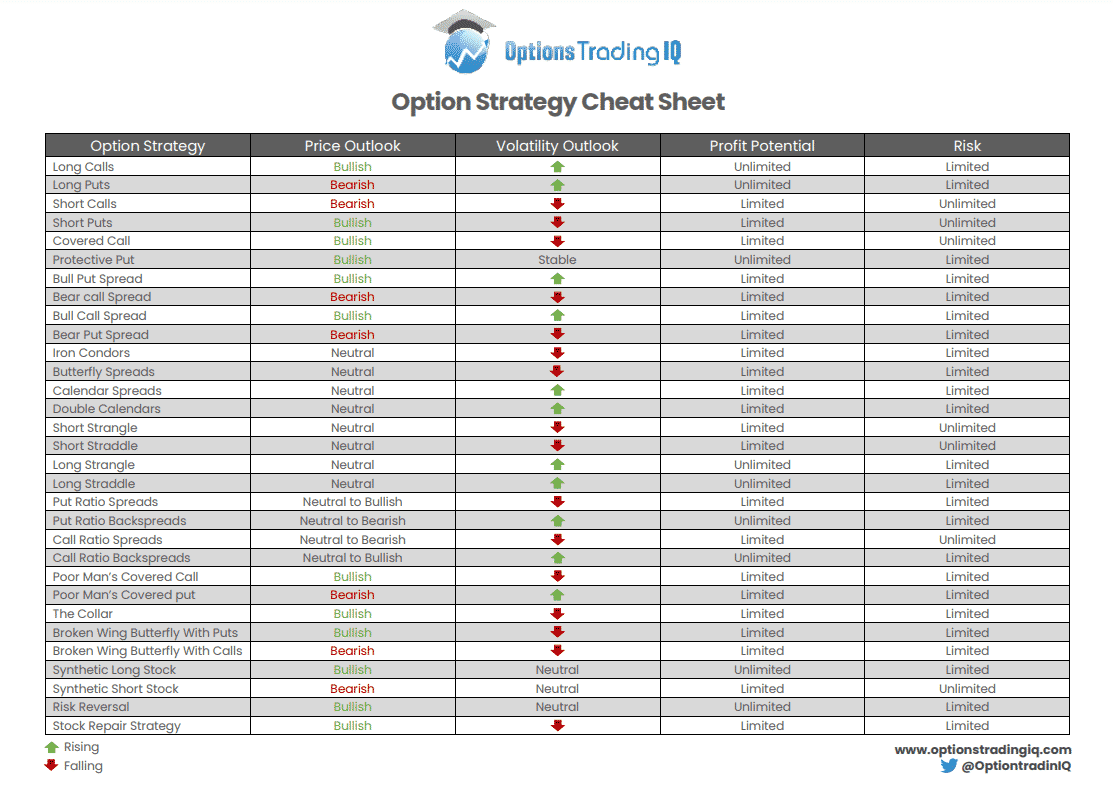

Option Strategy Cheat Sheet Two Free Downloads

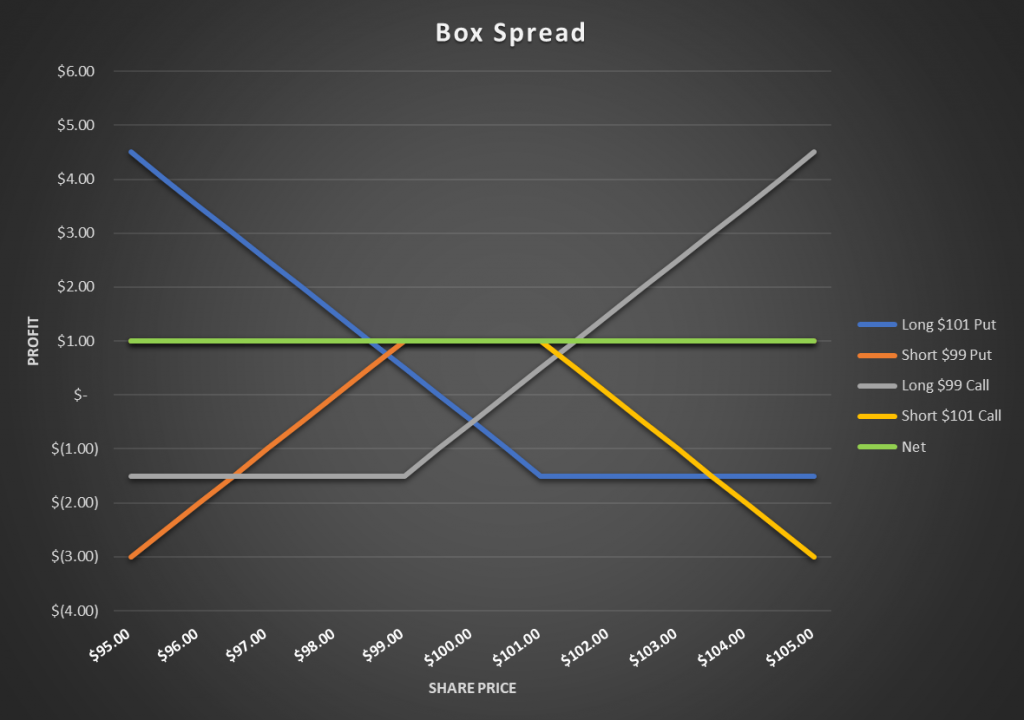

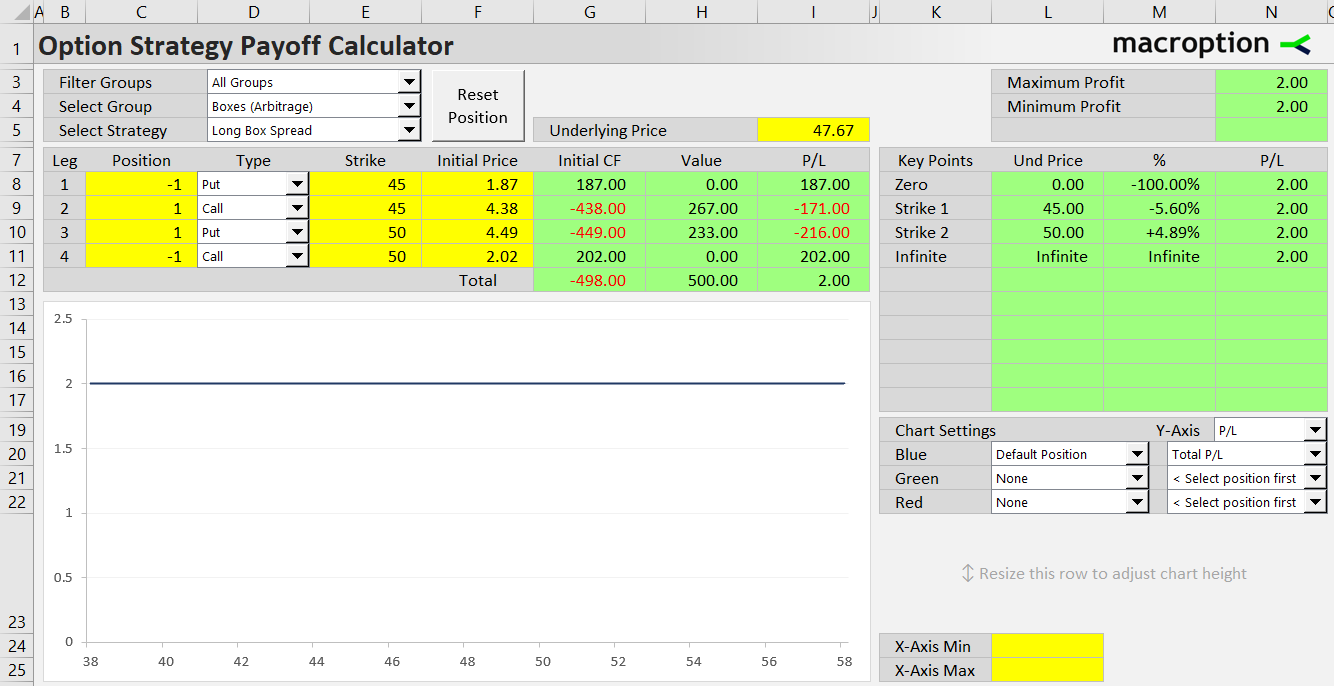

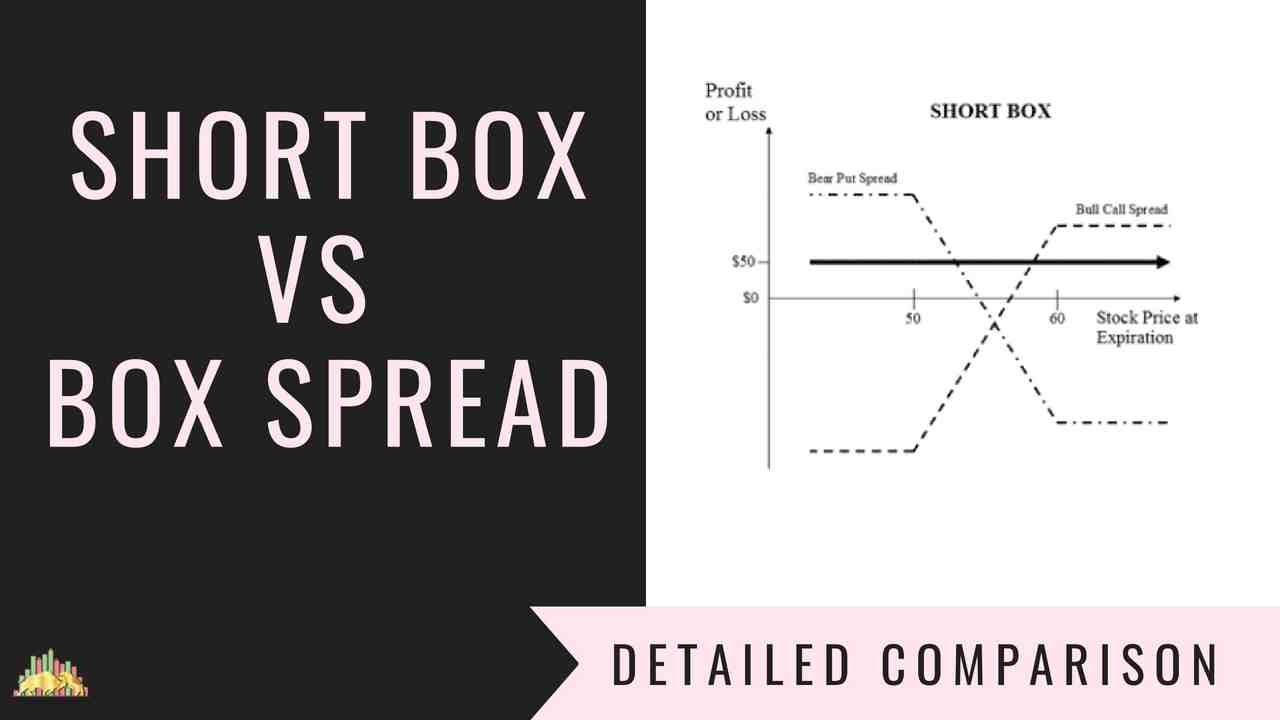

Profit diagram of a box spread. It is a combination of positions with a riskless payoff. In options trading, a box spread is a combination of positions that has a certain (i.e., riskless) payoff, considered to be simply "delta neutral interest rate position".

Trading Strategies Chapter 11 1 Disclaimer Some parts

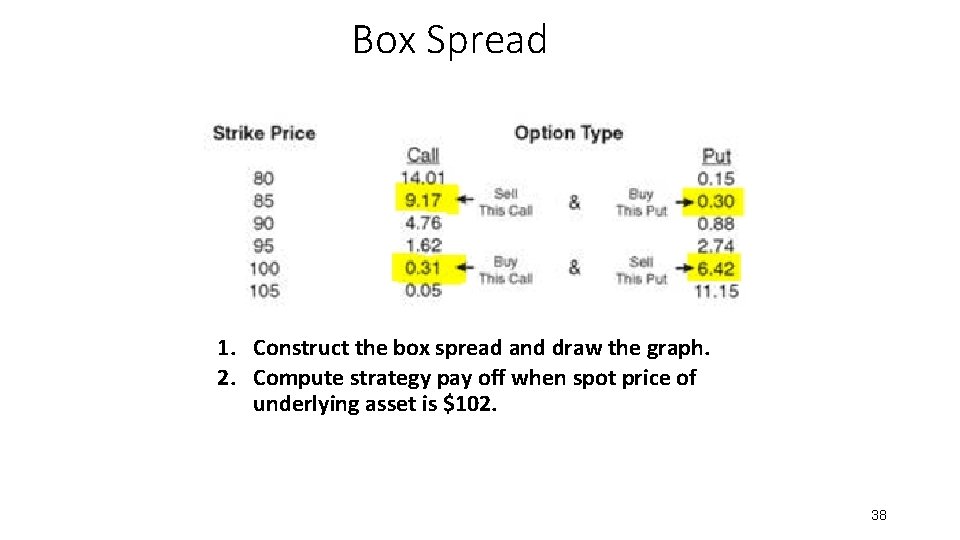

A box spread is an options arbitrage strategy that combines buying a bull call spread with a matching bear put spread. A box spread's ultimate payoff will always be the difference between the.

Options Strategies Cheat Sheet [FREE Download] How to Trade

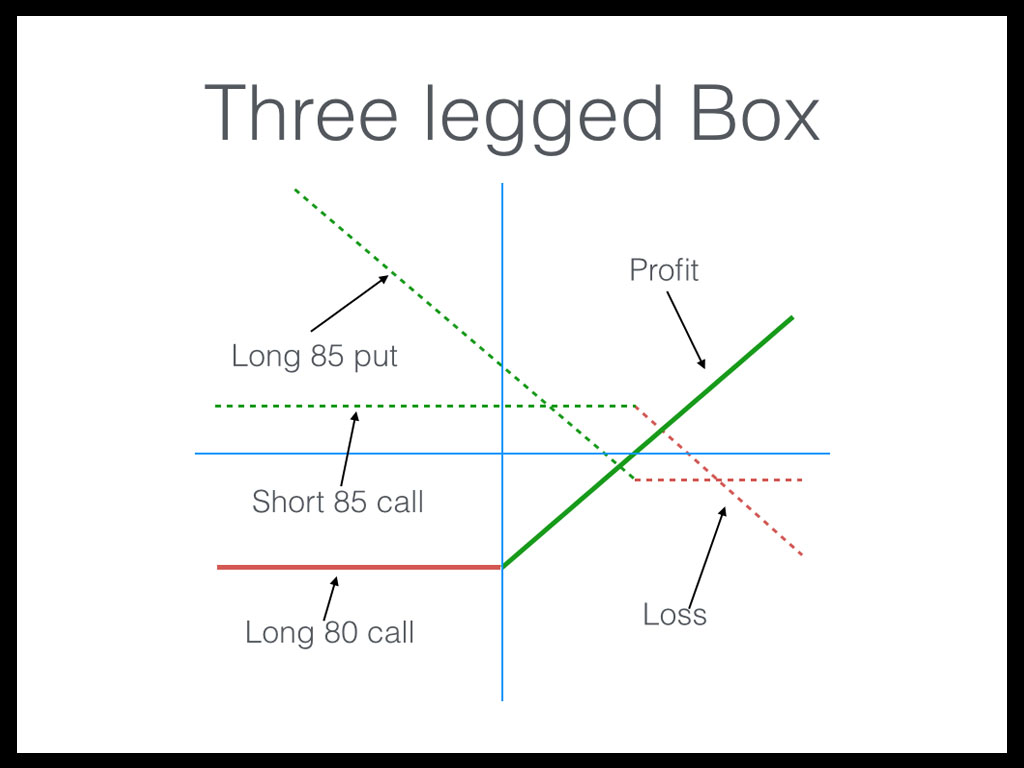

Buying a Box Spread. If the S&P is trading at 281, you can create a box spread by combining two strategies and using the same strikes on either side. The first strategy is a bull call spread, a debit spread where you're buying a spread on the call side of the pricing table. For example, you would buy the 275 call and sell the 285 call.

Short Box Spread Guide [Setup, Entry, Adjustments, Exit]

What Is A Box Spread In Options Trading? Contents What Is A Spread? What Is A Box Spread? Scenario Outcomes Conclusion A box spread is an options trading strategy that enables traders to profit from arbitrage. Arbitrage is the process by which a profit is Box spreads enable traders to make a risk-free profit by using arbitrage. Blog

What Is A Box Spread Options Trade? Raging Bull

Box spread trading is an options trading strategy that involves buying and selling options to create a market neutral position. This is an arbitrage opportunity where traders simultaneously trade 4 options contracts: 2 calls and 2 puts. These options have the same expiration date but different strike prices.

12 Powerful Option Trading Strategies Every Trader Should Know New

TheOptionBox Where insight meets innovation. Dive into a world of data-powered options, fluid strategies, and timeless wisdom with OptionBox. OptionsLab Stay a step ahead in the trading game with OptionsLab's deep market analysis. Everything you need for options analytics, all in one place Strategy Discovery

The ThreeLeg Box Random Walk Trading

Box options trading, also known as box spreads, is essentially an arbitrage strategy. By definition, the system involves simultaneously buying and selling an asset in different markets to take advantage of a price difference. Essentially, the trade consists of two vertical spreads, each entailing the same strike price and expiration date.

Box Spread Option Strategy A Comprehensive Guide

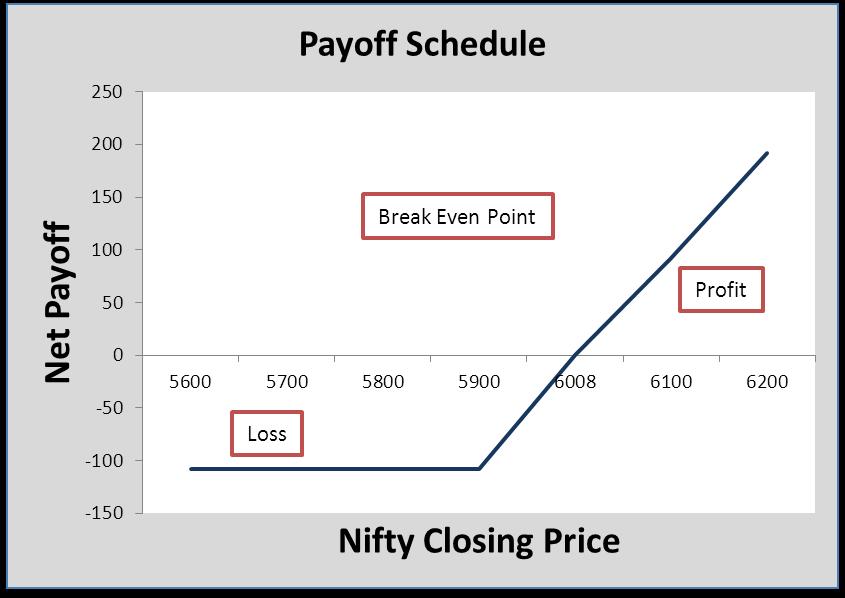

The bear put spread costs: $600 - $150 = $450. The total cost of the box spread is: $500 + $450 = $950. The expiration value of the box is computed to be: ($50 - $40) x 100 = $1000. Since the total cost of the box spread is less than its expiration value, a riskfree arbitrage is possible with the long box strategy.

What is a box spread tastytrade

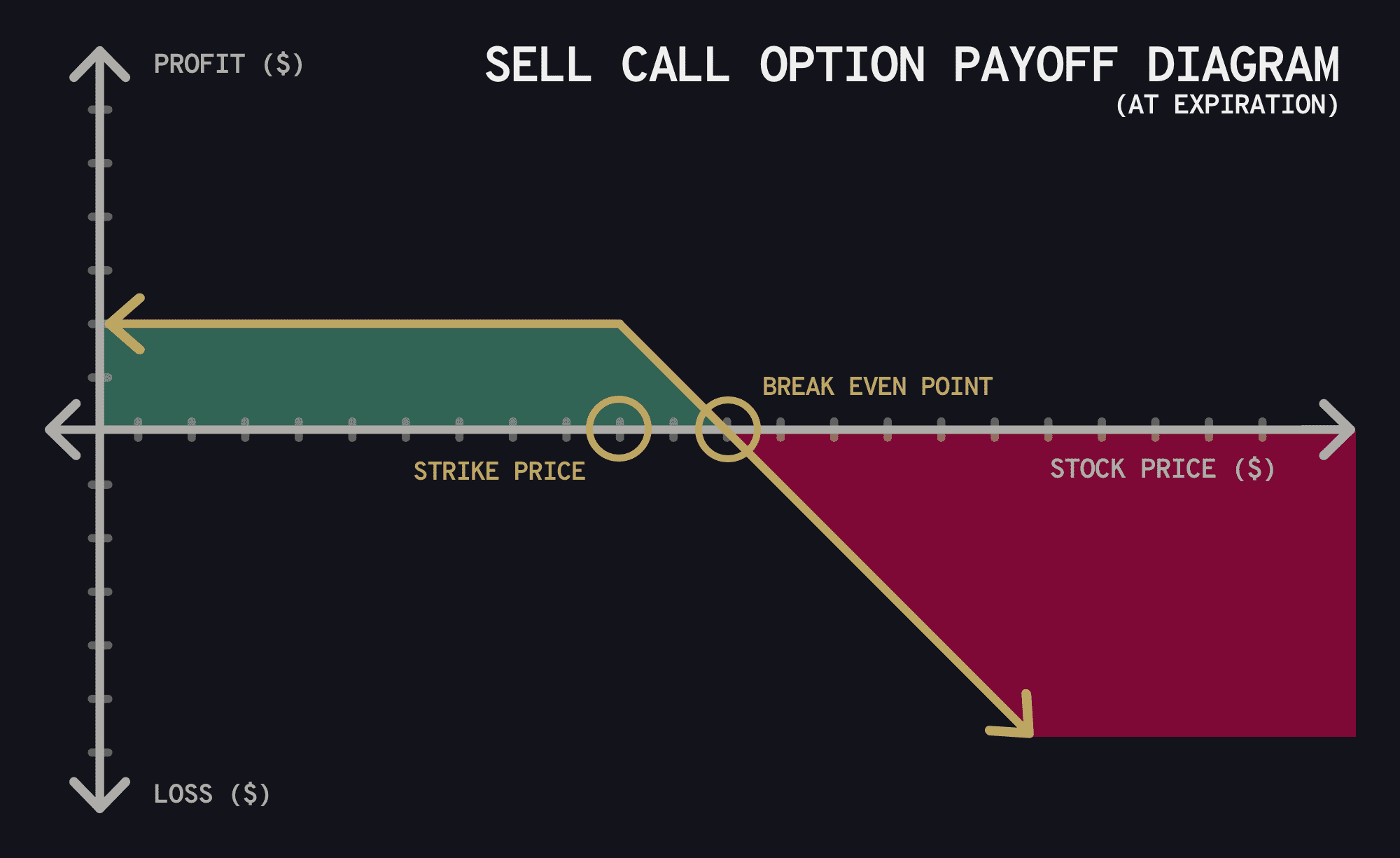

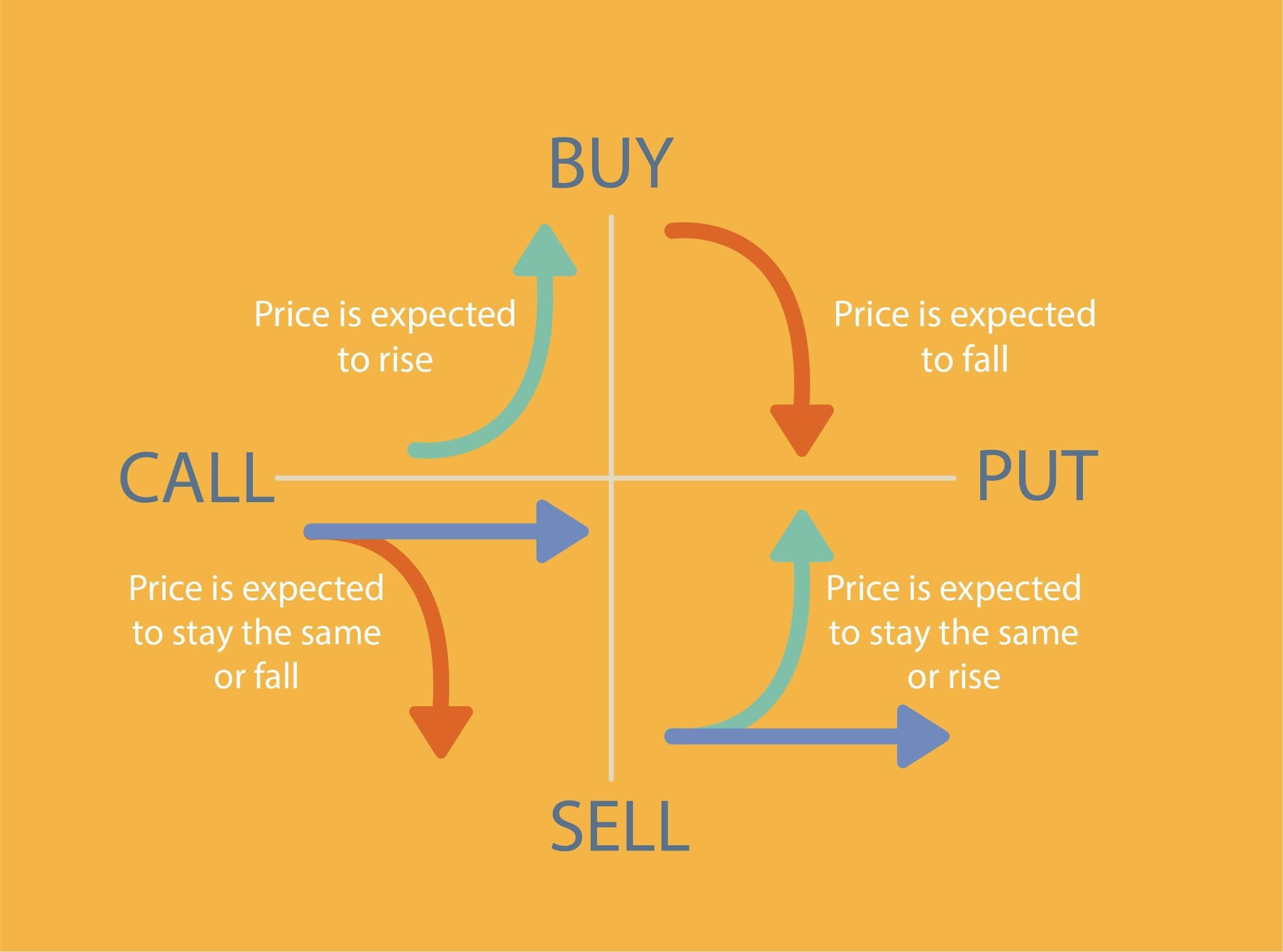

A $1 increase in the stock's price doubles the trader's profits because each option is worth $2. Therefore, a long call promises unlimited gains. If the stock goes in the opposite price.

Long Box Spread Option Strategy Macroption

Whether you are a beginner or an expert, The Option Box can help you find, create, and optimize your options trading strategies. Log in now and access the smart analytics, strategy discovery, and dynamic adjustment features.

Options Trading 101 Options Explained in Plain English regpaq

A box spread, or long box, is an options strategy in which a trader buys a call and sells a put, which yields a similar trade profile of a long stock trade position. Depending on which strike prices the trader chooses, the spread will come close to the current market value of the stock. The arbitrage strategy involves a combination of buying a.

Options Pt. 3 Time Decay And Its Impact On Options Trading Market

January 23, 2023 Beginner. A spread trade typically involves buying one asset and selling another. Read to learn ways to put on a spread trade. An options spread can take on many forms. It may be helpful to think of a spread like a bridge that connects two (or more) options and, when combined, the spread can offset some of the risk of holding a.

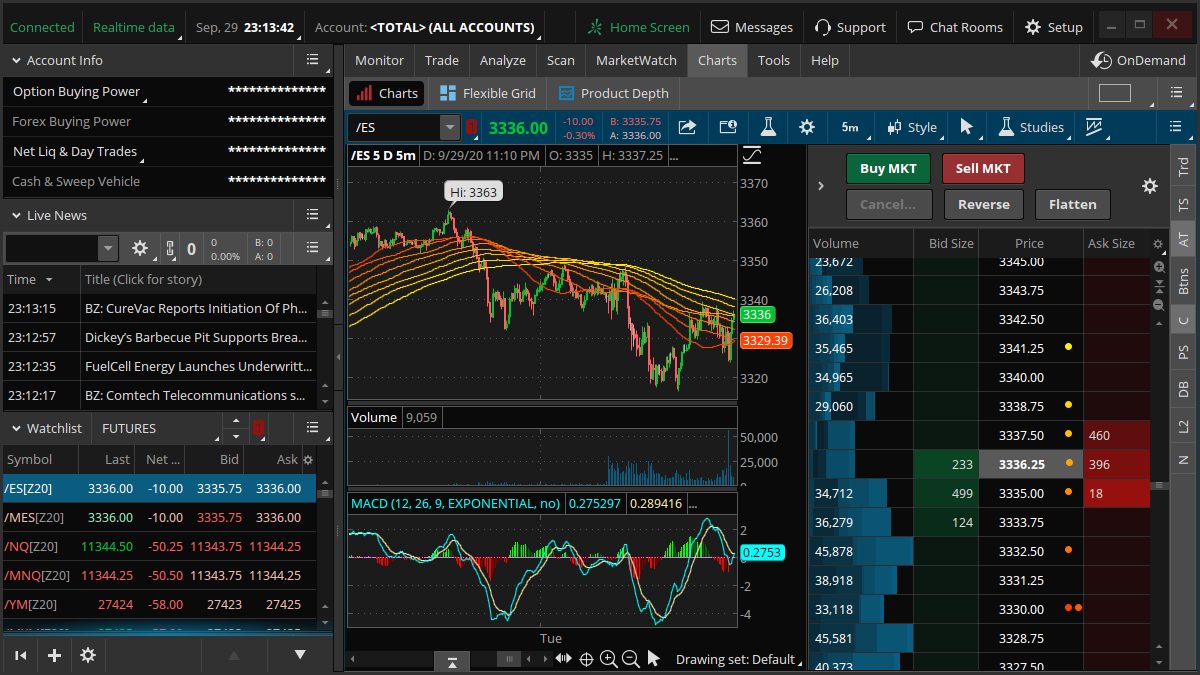

TD Ameritrade platform Review Definition and 2 Tools to Trade

What is Box Spread trading Strategy A box spread is a multi-leg, risk-defined, neutral options strategy with limited profit potential. Long box spreads look to take advantage of underpriced options and create a risk-free arbitrage trade.

Options Spread Strategies How To Win In Any Market

A box spread consists of buying one put option at or near the money and selling one put option at a lower strike price. You then buy a call option at or near the money and sell one call option at a higher strike price. Expiration Value of Box = Higher Strike Price - Lower Strike Price Risk-free Profit = Expiration Value of Box - Net Premium Paid

Options Trading Strategies Long Short Call & Put

A box spread is an options trading strategy that combines a bear put and a bull call spread. In order for the spread to be effective: The expiration dates and strike prices for each spread must be the same The spreads are significantly undervalued in terms of their expiration dates Source Box spreads are vertical and almost entirely riskless.

Short Box Vs Box Spread Options Trading Strategies Comparison

Options are a form of derivative contract that gives buyers of the contracts (the option holders) the right (but not the obligation) to buy or sell a security at a chosen price at some point in.